Ok, the flowers are beginning to bloom, I just bought a few potted tulips that are budding ready to bloom, it is to me symbolic of the current Real Estate market, READY TO BLOOM. I have been pretty busy over the past couple of months and even more so currently. So to my clients I thank you and ” Let’s find the house of your dreams”.

Ok, the flowers are beginning to bloom, I just bought a few potted tulips that are budding ready to bloom, it is to me symbolic of the current Real Estate market, READY TO BLOOM. I have been pretty busy over the past couple of months and even more so currently. So to my clients I thank you and ” Let’s find the house of your dreams”.

**Courtesy of 7933 Limekiln Road** Absolute Realty Realtor Gary Umansky**

If you wish to see this one let me know but make sure you mention me to Gary !!!

Most of my current BUYER clients are looking for generally the same type of house in varying different neighborhoods and areas. They are looking for a generally updated home with hardwoods or carpets, updated kitchen decked with stainless steel appliances, redone bathrooms with updated tiled walls and fixtures and possibly a finished basement. Ask Ms Norman, the lovely young lady that recently closed on such a home.

Most people now do not want to do ANY work to the home of their dreams but want to have it ALL redone and “move-in ready”.

But for the savvy, patient and discerning home buyer, there is another way……

The HUD 203K way!!

I know that sounds like a Prince line or an infomercial but it is true.

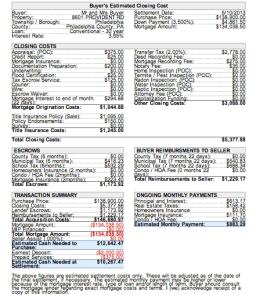

The HUD 203K and 203K Streamline Programs in conjunction with FHA. Now FHA, VA and many governmental agency that help secure mortgage loans for people at low rates and low down payments (3.5%) are common and frankly the best option for buyers with sufficient credit but lack the “conventional” 10 or 20% down payment . This loan allows a person to put only 3.5% down on their mortgage loan (plus the normal closing fees.)

** Note in closing it makes a heck of a difference***

** Note in closing it makes a heck of a difference***

However, FHA, VA and many of these programs have specific guidelines on how and when they lend money. One of those rules is that the house must be “habitable”. By habitable they mean that the home must have ALL the working and functioning components like functioning kitchen, bathroom and be safe and free of hazards. Sooo…. if there is not kitchen or stove, or running water or electric or functioning bathroom or any other items that you can think of. So if you found the house in the area of your dreams, with great bones and great schools, you might be out of luck if it is not up to FHA requirements.

Wait, in steps Mr 203k!!

Where you can borrow money for your NEW HOME, as well as money to make it “livable” ALL within your loan. Money to BUY. and Money to RENOVATE . This would allow you to make you OWn dream home, renovated in the EXACT way you envision all the way down to the tiles, paint, flooring style and color, window, doors, stove, etc., etc. ALL within your loan… if you are willing to undertake this endeavor. I have two current 203k loans going currently and will give an update as to how they do.

Below is more information about 203k mortgages.

203(k) – How It Is Different

Most mortgage financing plans provide only permanent financing. That is, the lender will not usually close the loan and release the mortgage proceeds unless the condition and value of the property provide adequate loan security. When rehabilitation is involved, this means that a lender typically requires the improvements to be finished before a long-term mortgage is made.

When a homebuyer wants to purchase a house in need of repair or modernization, the homebuyer usually has to obtain financing first to purchase the dwelling; additional financing to do the rehabilitation construction; and a permanent mortgage when the work is completed to pay off the interim loans with a permanent mortgage. Often the interim financing (the acquisition and construction loans) involves relatively high interest rates and short amortization periods. The Section 203(k) program was designed to address this situation. The borrower can get just one mortgage loan, at a long-term fixed (or adjustable) rate, to finance both the acquisition and the rehabilitation of the property. To provide funds for the rehabilitation, the mortgage amount is based on the projected value of the property with the work completed, taking into account the cost of the work. To minimize the risk to the mortgage lender, the mortgage loan (the maximum allowable amount) is eligible for endorsement by HUD as soon as the mortgage proceeds are disbursed and a rehabilitation escrow account is established. At this point the lender has a fully-insured mortgage loan.

Eligible Property

To be eligible, the property must be a one- to four-family dwelling that has been completed for at least one year. The number of units on the site must be acceptable according to the provisions of local zoning requirements. All newly constructed units must be attached to the existing dwelling. Cooperative units are not eligible.

Homes that have been demolished, or will be razed as part of the rehabilitation work, are eligible provided some of the existing foundation system remains in place.

In addition to typical home rehabilitation projects, this program can be used to convert a one-family dwelling to a two-, three-, or four-family dwelling. An existing multi-unit dwelling could be decreased to a one- to four-family unit.

An existing house (or modular unit) on another site can be moved onto the mortgaged property; however, release of loan proceeds for the existing structure on the non-mortgaged property is not allowed until the new foundation has been properly inspected and the dwelling has been properly placed and secured to the new foundation.

A 203(k) mortgage may be originated on a “mixed use” residential property provided: (1) The property has no greater than 25 percent (for a one story building); 33 percent (for a three story building); and 49 percent (for a two story building) of its floor area used for commercial (storefront) purposes; (2) the commercial use will not affect the health and safety of the occupants of the residential property; and (3) the rehabilitation funds will only be used for the residential functions of the dwelling and areas used to access the residential part of the property.

How the Program Can Be Used

This program can be used to accomplish rehabilitation and/or improvement of an existing one-to-four unit dwelling in one of three ways:

To purchase a dwelling and the land on which the dwelling is located and rehabilitate it.

To purchase a dwelling on another site, move it onto a new foundation on the mortgaged property and rehabilitate it.

To refinance existing liens secured against the subject property and rehabilitate such a dwelling. To purchase a dwelling and the land on which the dwelling is located and rehabilitate it, and to refinance existing indebtedness and rehabilitate such a dwelling, the mortgage must be a first lien on the property and the loan proceeds (other than rehabilitation funds) must be available before the rehabilitation begins.

To purchase a dwelling on another site, move it onto a new foundation and rehabilitate it, the mortgage must be a first lien on the property; however, loan proceeds for the moving of the house cannot be made available until the unit is attached to the new foundation.

This is the link to the HUD 203K Handbook to read more and get more information (click this link). Most any mortgage broker should be pretty versed on this program. As always call email, or text me with any questions about it as well.

Hi! Do you use Twitter? I’d like to follow you if

that would be okay. I’m absolutely enjoying your blog and look forward to new posts.

LikeLike

Yes, it is d21parker. Friendly warning it is not always about Real Estate but always interesting Lol. Actually my Twitter thread is located on the blog on the left hand side. Thanks for viewing.

LikeLike

Sorry for the delay, been super, super busy. My twitter is d21parker. I have a team partner so I will be less-busy meaning… more posts

LikeLike